With the announcement of a £25 billion super-deduction tax break in the last budget, organisations will be able to claim 130% tax relief on spending against capital equipment. Designed to fuel business growth, we look at how the savings are applied and how it can provide welcome financial support for your weighing investments.

Why has the Government introduced the super-deduction tax break?

During the Pandemic, levels of investment have fallen, with a reduction of 11.6% between 2019 and 20202. Understandably, the economic shock and uncertainty have resulted in a reluctance to invest. In direct response, tax reliefs have been introduced to give organisations a helping hand to grow by incentivising investment in productivity-enhancing machinery3.

How does the super-deduction tax break work?

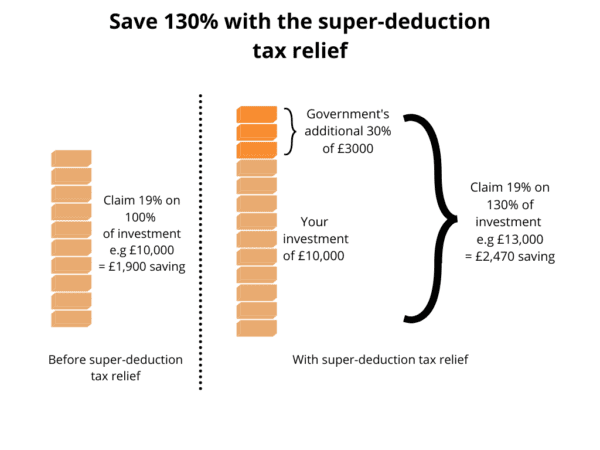

Running from April 2021, the super-deduction tax break provides the opportunity to access a further 30% in tax relief against capital investments. For organisations that pay Corporation Tax, this could equate to a total of 130% tax relief against machinery. In practical terms, if your organisation is subject to the 19% standard tax rate, savings could work as follows:

£10k investment:

- Your company spends £10k on new weighing equipment

- You now get an allowable capital investment deduction of £13k

- Your corporation tax relief is now 19% on £13K

- That equates to £2,470 of tax savings versus £1,900 prior to April 2021

£1m investment:

- Your company spends £1m on new weighing equipment

- You now get an allowable capital investment deduction of £1.3m

- Your corporation tax relief is now 19% on £1.3m

- That equates to £247,000 of tax savings versus £190,000 prior to April 2021. An additional tax saving of up to £57K

Figure 1. example of super-deduction savings

Qualifying weighing machinery and equipment can include (but are not limited to) new analytical balances & bench scales, platforms, inspection equipment, and weighbridges. Unfortunately, second-hand, or refurbished equipment are exempt from the tax relief but hire purchase contracts are included as qualifying expenditure. However, all new assets must be in use within the financial year that you are claiming the super-deduction tax break for your equipment to qualify6.

Making the right weighing investments

The super-deduction tax relief offers a prime opportunity to replace, upgrade or add to your existing weighing equipment. However, it can be an arduous process to identify the right equipment for your needs while satisfying internal and external compliance regulations.

At Northern Balance, our complimentary and no-obligation surveys include the following checks and discussions which are designed to provide a comprehensive assessment of the condition and suitability of your equipment against your weighing objectives:

- A comprehensive audit of your weighing processes. This includes checking the condition of the equipment, reviewing its location, and advising on how the existing weighing process could be improved in line with your weighing goals. For instance, this could involve a discussion on how data processing and recording could be improved at weighing stations and subsequent weighing solutions where this is a key focus.

- Advice on the age or potential obsolescence of scales and discussing the impact of them being out of action for a long period of time.

- Updating your asset register. This involves recording and updating important information, such as calibration dates and the identification of critical equipment, supporting audit processes, and compliance against regulations.

- Review of existing weighing agreements and their suitability. For example, does your agreement provide the right level of cover? Where your weighing process is critical, does your contract include backup equipment and emergency callouts in the timeframe you need?

Weighing up your equipment investment options should not be taxing. Conducted by a skilled engineer, the surveys will enable you to make informed decisions about where to invest, any additional weighing support that will help to enhance your processes as well as available finance options that will support your needs. Make the most of the super-deduction tax break by contacting us to arrange your free survey today.

Sources

1 and 2 Swoop (2021) ‘The super-deduction allowance’ [Online] Available at https://swoopfunding.com/uk/covid-19/super-deduction/ (Accessed 14th April 2021) Paragraphs 1 and 2.

3 GOV.UK (2021) ‘Super-deduction’ [Online] Available at https://www.gov.uk/guidance/super-deduction (Accessed 14th April 2021)

4 Office for Budget Responsibility (2021) ‘Economic and fiscal outlook – March 2021’ [Online] Available at https://obr.uk/efo/economic-and-fiscal-outlook-march-2021/ (Accessed 19th April 2021) March 2021 Economic and fiscal outlook – Executive summary PDF Section 1.34

5 HM Treasury (2021) ‘Budget 2021 – Super-deduction’ [Online] Available at

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/967202/Super_deduction_factsheet.pdf (Accessed 14th April 2021)

6 Batham-Tomkins, K (2021) ‘Super Deduction’ [Online] Available at https://bhp.co.uk/news-events/blog/super-deduction/ (Accessed 14th April 2021)